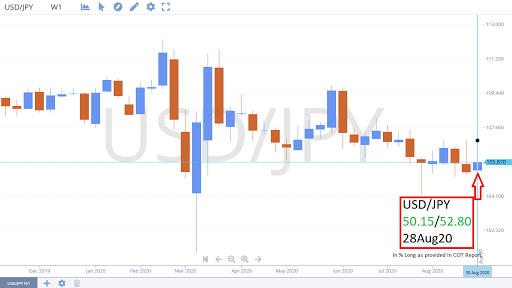

Commitment of Traders as of 25 August 2020

| COT Report | Ave | |||

| As of 25Aug20 | Long | Short | ||

| CAD | 54.31% | 45.69% | ||

| CHF | 55.69% | 44.31% | ||

| GBP | 53.13% | 46.87% | ||

| JPY | 52.80% | 47.20% | ||

| EUR | 58.78% | 41.22% | ||

| NZD | 53.04% | 46.96% | ||

| AUD | 53.71% | 46.29% | ||

| USD | 50.15% | 49.85% | ||

| XAG | 59.08% | 40.92% | ||

| XAU | 61.87% | 38.13% | ||

All currencies are up from August 19-25, 2020, and reported on the 28th of August 2020, Friday.

The

Commodity Futures Trading Commission is the one who gathers all

information and regulates the trading for both currencies and

commodities in the U.S. They usually release data every Friday which

includes the latest data from previous Tuesdays. The Commodity Exchange

Act regulates the trading of commodity futures in the United States.

Passed in 1936, it has been amended several times since then. The CEA

establishes the statutory framework under which the CFTC operates. Under

this Act, the CFTC has the authority to establish regulations that are

published in title 17 of the Code of Federal Regulations.

Commitment

of Traders gives us also a blueprint where will market may lead. So

what I did is, I usually download data every Saturday due to time

difference between U.S. time and Philippine time, and add the long and

short positions of non-commercial, commercial, and nonreportable

positions. Then I convert those into percentages.

We'll see this week trading how many pips increase on your favorite Forex pairs from August 31-September 04, 2020. Happy trading!